Zahlungsverkehr & Regulierung

Wir unterstützen Banken bei der Umsetzung und dem Betrieb moderner Zahlungsverkehrs- und Compliance-Systeme.

Im Fokus stehen regulatorische Anforderungen, stabile Infrastrukturen sowie die sichere Abwicklung nationaler und internationaler Zahlungen – von SEPA bis SWIFT.

Die folgenden Bereiche zeigen, wie wir Banken bei Betrieb, Migration und Weiterentwicklung ihrer Zahlungsprozesse unterstützen.

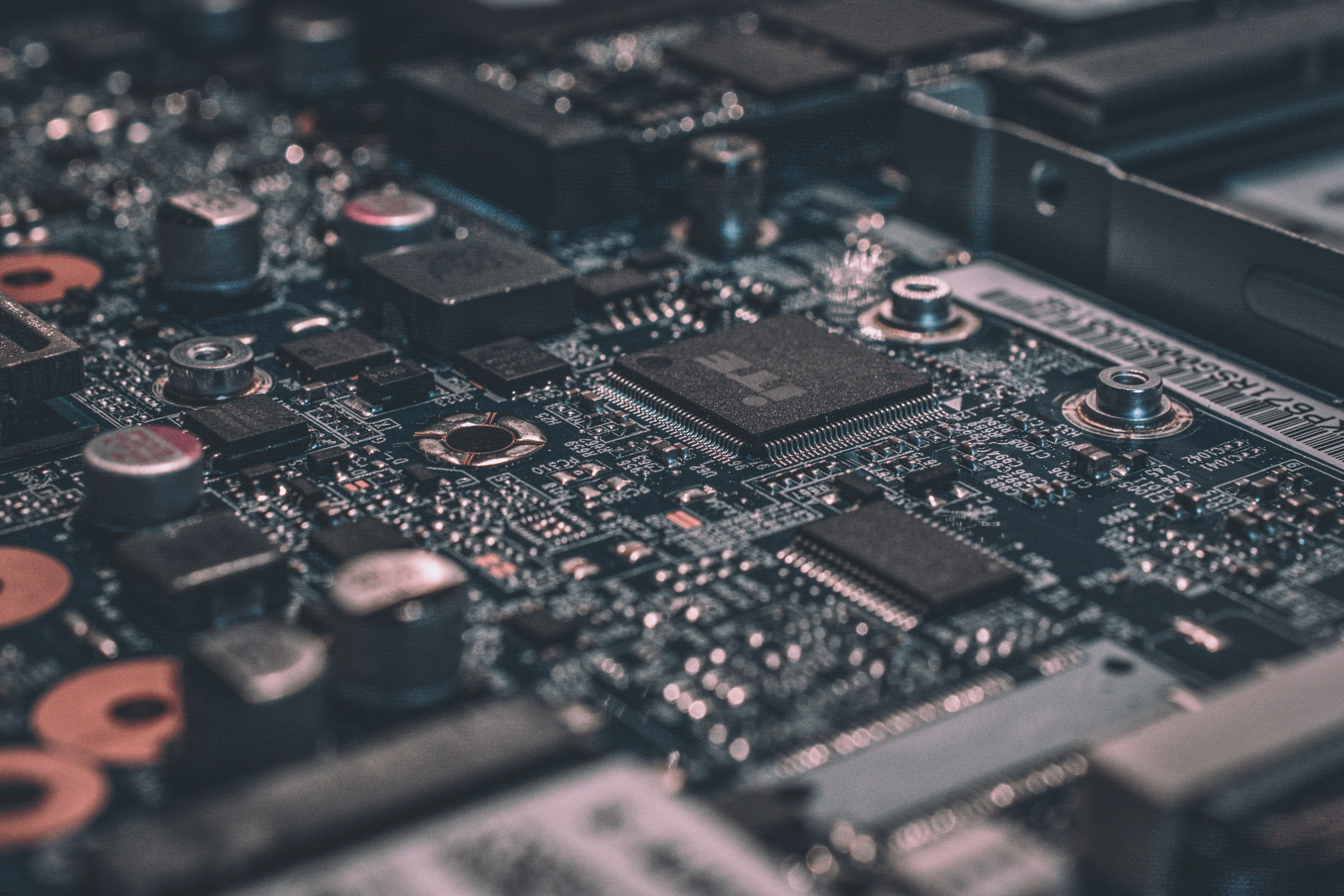

Digital Operational Resilience (DORA)

DORA requires financial institutions to strengthen the resilience of their IT systems, processes and third-party dependencies against operational and cyber risks.

We support banks in implementing regulatory requirements, risk assessments and integrating DORA into existing payment and core banking infrastructures.

Business Continuity Management

BCM ensures that critical payment processes remain operational even in the event of disruptions.

We support emergency concepts, recovery plans and regulatory integration into IT and payment infrastructures.

National clearing systems

SIC (Switzerland) and CHAPS (UK) are core real-time gross settlement systems.

We support connectivity, migrations and integration into global payment platforms.

EBICS in corporate banking

EBICS is the standard for secure electronic payment communication between banks and corporates.

We support implementation, migration, key management and regulatory compliance.

TARGET services and ESMIG

TARGET and ESMIG form the technical backbone of European high-value payments.

We support connectivity, migrations and stable operations within the TARGET ecosystem.

Migration to ISO 20022

ISO 20022 is the global standard for payment messaging.

We support analysis, mapping, coexistence phases and secure migration from legacy formats.

SWIFT releases and GPI

The SWIFT 2024 release introduces new requirements and optimizations.

We support release upgrades, GPI integration and enhanced payment transparency.

PSD3 and future regulation

PSD3 will further evolve existing payment service regulations.

We support early analysis, architectural decisions and strategic preparation.

SWIFT in global payments

SWIFT is the backbone of global financial messaging between banks and financial institutions.

We support migrations, major releases, security requirements and seamless integration into existing payment infrastructures.

Single Euro Payments Area (SEPA)

SEPA enables standardized euro payments across Europe and continues to expand.

We support banks in regulatory adaptations, SEPA area expansion and new requirements such as Instant Payments.

Real-time payments and Verification of Payee (VOP)

Instant Payments enable real-time transfers 24/7.

We support the implementation of VOP checks, fraud prevention mechanisms and secure integration into existing payment systems.

Transaction controls and fraud prevention

Embargo, sanctions and fraud checks are essential for regulatory compliance.

TRXCC-based controls enable early detection of critical transactions directly within payment flows.