Network and Information Security (NIS2)

NIS2 strengthens cybersecurity, risk management and incident reporting requirements for critical and important entities.

We support governance, technical safeguards, incident handling and compliant implementation.

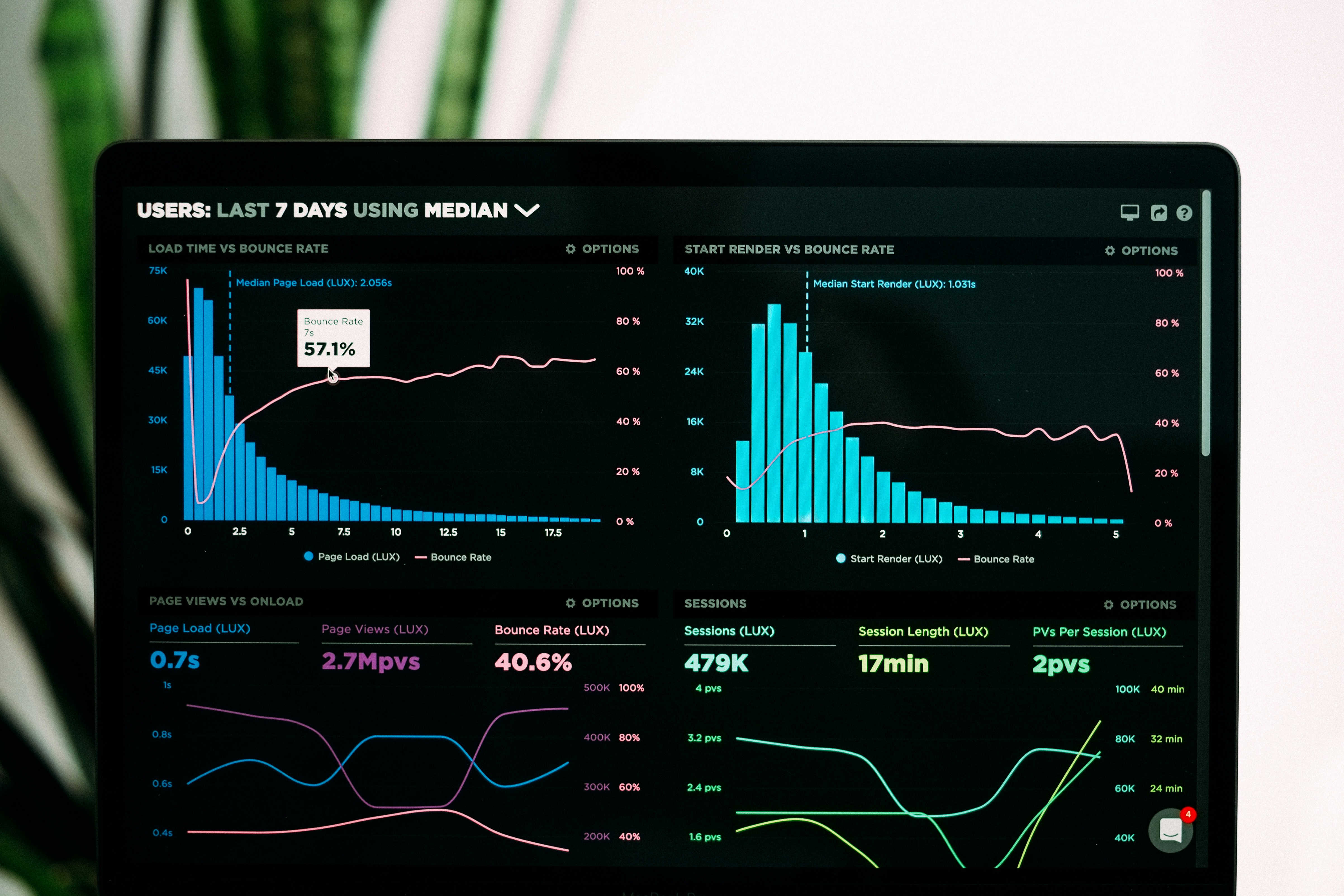

Real-Time Liquidity Monitoring

Real-time visibility of balances and payment flows to ensure liquidity at all times.

We integrate liquidity data from payments, clearing and core banking systems.

VOP Pre-Check and Verification of Payee

Verification of Payee prevents misdirected payments by validating beneficiary data before execution.

We support pre-checks, system integration and compliance.

Payments Anywhere

Cross-border payments across all relevant networks – efficient and compliant.

We unify domestic and international payment rails.

SWIFT and EBICS for Corporates

Secure connectivity for corporates to banks and payment networks.

We deliver host-to-host connections, formats, security and monitoring.

Instant Payments for Corporates

Real-time payments with immediate liquidity availability – 24/7.

We integrate instant payments into ERP and treasury systems.

Embargo and Fraud – TRXCC

Automated screening against sanctions lists and fraud patterns in payment flows.

We integrate TRXCC logic for preventive and reactive protection.

Global Payment Orchestration

Centralized control of international payment instructions across networks.

We harmonize formats, processes and systems globally.

GPI for Corporates

Near real-time transparency and tracking of international payments.

We integrate GPI tracking directly into banking and corporate systems.